Many of us dream of buying an overseas property – somewhere to escape the stresses of daily life and to hold as an investment for the future.

Yet for every individual who puts their money where their mouth is, there are plenty of others who are put off by the scaremongers and talk of bureaucracy, hidden fees, language barriers and crooked local agents.

Most people don’t even make it to the research phase of the investment process; those who do soon realise that buying a property in Spain is relatively straightforward and certainly no more complex than in most other European states.

However, things don’t always run smoothly and, as in any market, it’s essential that your take the time to understand Spain’s property market and how it operates.

Having conducted numerous interviews with second home buyers in Spain, we at CASAFARI have compiled a breakdown of the different processes and steps to follow.

Step one – Online research

The biggest time investment you’ll make when buying a property in Spain will be in research. This is especially true when it comes to buying in an unfamiliar market.

While we would always advise buying your property in Spain through an accredited estate agent, as opposed to directly from the seller, be aware that this individual will be acting for the seller in the first instance.

It’s also worth noting that only around 60% of Spanish realtors are likely to speak your native language. It’s also highly likely that they may not have actually set foot on the property they’re selling themselves.

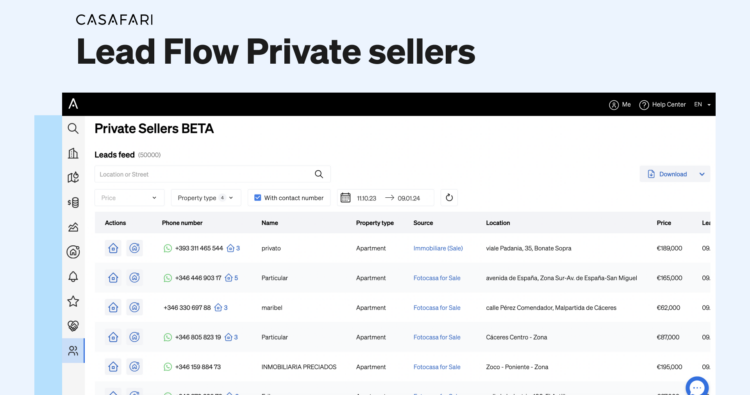

It’s therefore up to you to do much of the legwork yourself during the research phase – online property portals will naturally be your first port of call, with the overwhelming majority of properties likely to be listed through this method.

Homes targeted at international buyers will typically be marketed on international portals, namely the Spanish sub-sites of Rightmove and Zoopla.

However, it’s worth casting your net a little further to include local property portals – the best known include Servihabitat; comprarcasa; idealista.com and Venta de Pisos.

Try to cross-reference as many sites as possible as it’s common to find the same property listed on a number of portals with a different price tag attached. In the Balearics, price discrepancies of up to 46% have been noted in recent months.

Most sites allow you to set up search alerts, saving additional time during the research stage.

Step 2 – Getting to know the area

Having narrowed down where you wanna move forward with buying a property in Spain, it’s important to spend as much time as possible getting to know the area. Among the obvious things to look for from an investment standpoint are the recent price trends in the region.

Spain’s property market is more schizophrenic than most. In a small market like Mallorca and Ibiza you’ll find areas with high demand and strong appreciation potential juxtaposed by locations that have remained the typical investor’s radar and where there’s been very little growth in recent years.

It’s important to choose your area carefully to ensure strong resale potential. Prices, even in a small market like Mallorca, will vary significantly as will the future growth potential.

Homes in the south-west of the island, for example, move quickly. The area enjoys proximity to the regional city, Palma de Mallorca as well as Spain’s third largest airport, and it has become a hotspot for high-net-worth buyers from across Europe.

By contrast, the north-east of the island has yet to see the same influx of tourists and overseas investors. Entry levels are lower, however, there isn’t the obvious resale potential and purchasers may find it harder to find international buyers and to make a profit on their investment.

It is important to consult authoritative, independent sources before deciding exactly where you want to look for your investment property. Local estate agents won’t necessarily have all the information you need or be able to tell you how much your property is likely to be worth a few years down the line.

CASAFARI provides details of neighbourhood guides and price information on the Balearic Islands – visit CASAFARI to find out more.

Of course, nothing compares to actually visiting the location where you’re thinking of buying for yourself and sounding out the locality. You will soon be able to gain a sense of whether it is a good area in which to be investing.

A property that seems like a dream home could turn out to be at a considerable distance from the nearest amenities or in the shadow of the local sewage treatment plant.

By spending time viewing a range of properties, you should be able to hone in on the home that’s best matches your needs and which offers the greatest investment potential.

Step 3 – Lawyering up

Having identified a property to buy, your next move is to get the appropriate expertise in place. Navigating the complexities of a foreign property market single-handedly is ill-advised, and a lawyer will be an essential ally at this stage of the home buying process.

A lawyer will provide you with the security that certain conditions of the property purchase have been met. For instance they will be able to ascertain that appropriate planning permission has been obtained and that there are no outstanding debts attached to the property, whilst consulting with a surveyor or architect to check that the building is structurally sound.

Your lawyer should be registered with the Spanish Bar Association, or Colegio de Abogados.

Depending on how good your Spanish is, you may also be advised to engage a professional who speaks your language – the British Embassy’s list of English speaking lawyers and translators is a useful resource.

If there are no bilingual lawyers registered in the area you are hoping to invest in, you can always hire a translator to help you with your communications.

A qualified lawyer will be able to take charge of the technicalities of the home buying process, as well as helping to set up the final paperwork for you to sign, they will ensure the property you are buying, is free from any outstanding invoices, or charges such as mortgages or injunctions.

They can also check to see whether the home has any current lessees or tenants and whether there any monies due to a tenants’ association, or unpaid property taxes attached to the home.

You should also ask for a breakdown of the annual running costs of the property; electricity prices can have significant regional variations, and some parts of Spain have suffered severe water shortages in recent years.

Most of the above information can be easily found from the local property registry (Registro de la Propiedad) who will be able to provide you with the details you need via fax or email. This is where a lawyer (and/or translator) comes in handy.

Land registry information can be requested from the Land and Mercantile Registrars’ Association of Spain in both Spanish and English. The local registry will be able to provide proof of who owns the home and of any loans or charges against it.

Step 4 – Taxes and all that jazz

Sadly, tax is a necessary evil in any property transaction that would’n be different for buying a property in Spain. Spain’s taxation authorities are surprisingly vigilant so it is critical that you fully understand the taxes you will be liable for, and that you remain compliant at all stages of the homebuying process.

In Spain, the buyer is responsible for paying property taxes and other costs. VAT and stamp duty must be paid when purchasing a new build property from a developer, whilst transfer tax is charged when buying an existing property from a private seller.

Taxes on existing properties typically range from 5-10%; in addition to this you will be required to pay Notary fees, title deed tax and a land registration fee, which will be in the range of 1–2.5%.

Step 5 – Making your offer

Now comes the fun part. The offer-making process in Spain works much as it does in other countries; despite what the agent brokering the deal may tell you, you are perfectly entitled to haggle on the price.

The exact discount you ask for will depend on different factors, such as how long the home has been on the market and how quickly the owner needs to make the sale.

It will also depend on the area you are buying in – there will obviously be more competition in a ‘hot’ market with a good deal of foreign interest, and a low-ball offer may take you out of the running.

Don’t rush in – think carefully about your offer and compare the asking price to that of other listings in the area.

If your offer is accepted, you will need to make a deposit and this is typically set at 10% of the final asking price. This should be accompanied by a simple contract until the public deed of purchase is issued. This is a contract of intentions, where the property owner expresses their interest in selling to the prospective buyer, and vice versa.

This agreement is called ‘Contrato de Arras’, and in most cases, if the buyer cancels the deal, he or she loses their deposit. The seller is also subject to a penalty if they decide to withdraw from the transaction.

Step 6 – Sealing the deal

This is clearly the most critical phase of the process and the culmination of weeks of research and planning. Whether or not you’ve engaged the services of a solicitor, it is important that you understand exactly what’s involved.

The agreement should ideally be drawn up in the form of a notarised deed; it then becomes a public document authorised by a public Notary. This document is legally recognised throughout Spain and can be used as proof of purchase. The party buying the home is responsible for choosing the Notary for the transaction and for paying their fees.

Once the final balance of the transaction has been received by the seller and both parties have signed off on the transaction, it then needs to be registered at the local property registry. We recommend that you do this personally, or through your estate agent or lawyer. This way your ownership of the property is rubber stamped.

In addition to a notarial deed you will need to obtain the Title Deed to the property (Escritura publica de compraventa de vivienda). The ‘Escritura’ is a legally binding document that certifies the change in legal ownership and contains information about the size and construction of the property, as well as additional information on costs, mortgages and other payments.

With all the i’s dotted and t’s crossed, it’s finally time to kick back with a bottle of sangria and toast your success. You are now the official owner of your very own Spanish property!

Remember, you can visit casafari.com for up-to-date pricing information and neighbourhood guides to the Balearic Islands.